Top 7 Insurance Technology Trends to know in 2023

The Covid-19 pandemic was an inflection point for the insurance sector globally. The year 2020 was inundated with massive redirections in the way the entire sector looked ahead into its future. With the recovery phase in the year 2021 where the focus was to meet modified customer expectations, the year 2023 is going to take the sector further ahead on the road to massive digitization for the customers.

While the technological advancements were already acting as a major disruption to the industry, the pandemic acted as a catalyser to the process. The carriers which adapted to the needs of changing times quickly were able to garner more business from people locked inside their homes.

Read more: Top Features to Have in Your Insurance Application

Top 7 Tech Trends in the Insurance Industry

Let us explore together the top 7 insurance technology trends of the year 2023.

- Automation in Underwriting Process

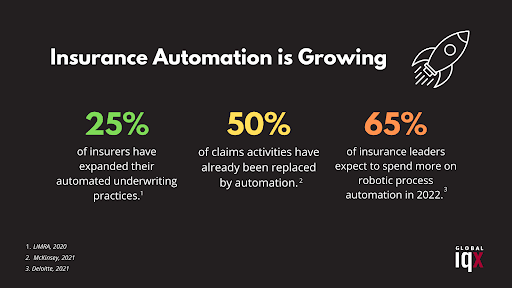

- The bug of automation has finally bitten the insurance sector. The old culture of paperwork and physical signature seems to be on a decline. Insurance underwriting is a long and tiring process because it involves coordinating with multiple agents and customers all the time. This makes the job hectic which in turn affects the accuracy of the job. Automation of the underwriting process has a great potential to answer this issue.

- Enterprise software development projects have already helped insurance firms to automate this manual task. According to a survey by LIMRA, 74% of insurance companies who benefited from accelerated underwriting have seen a reduced wait time for policies, 59% have realized a reduction in policy cost while 37% have seen a gain in their sales. Therefore, this trend of underwriting automation is bound to continue in 2023.

- Creating a Seamless Claims Experience

- Providing a lean and clean customer experience is very pivotal for any insurance sector enterprise. The most important experience for any policyholder is the claims process in the times of crisis. The more the process is frictionless, the more policyholders are likely to endorse your service. As per a report by EY, 87% of policyholders say the claims experience directly impacts their decision to remain with their insurance provider.

- With this in mind insurance companies may prioritize it and work with insurance app development company to automate this process. By reducing the barriers to the claims process, the insurance firms can delight the customer and not only retain their business but also gain more clients as a result of positive word of mouth.

- Automated Renewal

- Attracting business from new policyholders is one thing but retaining the business of the existing policyholders is also essential. Thus, the process of renewal of policies of existing policyholders is very crucial.

- Insurance app development services are helping insurance firms in developing an automated renewal application process. It can reduce the manual effort in queuing quotes and reviews by auto-generating policy renewal packages. Therefore, it is safe to say that insurance app development experts will see a high engagement from insurance companies in 2023 for the automation and streamlining of the renewal process.

- Making Mobile Applications for the Future

- With the advent of smartphones and advancements of cheap internet, anything is just a click away- then why not insurance. Insurance mobile app development will see an upwards trend in the development and quick adoption by the policyholders. In the future, the insurance mobile apps are bound to become a single point of contact for both the firm and the policyholder for any activity ranging from purchase of a new policy to claims and renewal.

- Increased use of Cloud Services

- As per qualified researchers, the trend of the rise in growth of policyholders will see a further upsurge. 2023 will be a year of a tremendous rise in the number of new policyholders. This behavior can partly be attributed to the post-pandemic realization of the customers subscribing to insurance policies to handle unforeseeable crises. It is estimated that the business may cross $500 billion in 2023.

- To manage the data surge as a result of the expected growth of clients, more and more insurance companies are expected to spend on cloud-based technologies to meet their operational needs.

- Total Digital Transformation

- A study by Deloitte reflects that in 2022, 65% of insurance leaders are expected to spend more on robotic process automation for increasing the efficiency of different processes and reducing the overall cost and time taken to serve the policyholders. The old methods are outdated and make the processes like claim settlement, renewal, underwriting, etc. slow and costly. As a result, the companies become less productive and competitive in the market.

- The insurance business owners have realized globally that they need to transition to a more digital model of business as soon as possible to stay ahead of time in the highly competitive and risky business. Therefore, they are on the lookout for insurance app development solutions providers to deploy more cutting-edge digital applications.

- Health Wearables

- The demand for health care wearables is booming. Modern insurance providers are utilizing this technology by linking their products to it. These devices monitor data such as daily steps, sleep patterns, heart rates, temperature, oxygen levels, activity level, etc.

- Some modern-day insurance providers monitor the health data gathered from the devices to reward their policyholders for healthy living and also to provide customized health plans more relevant to an individual policyholder. Moreover, the health data can be used to give complimentary coverage or improved rates for both individuals and employee benefits using health and risk scores.

Read more: Top 7 Reasons Ruby on Rails is good for Insurance Applications

Conclusion

Big businesses always envisage becoming more efficient in the future. The insurance technology trends has made it clear that insurance firms are going to spend more on insurtech in 2023. By opting for the best custom software development company, insurance firms can build state-of-the-art internal systems powered by AI, predictive analytics, chatbots, etc.

In the time ahead insurance companies will have to make a lot of critical choices regarding which technology to invest in.

If you are an insurance firm and ready to invest in technology, contact us for a Free Consultation.