How Digital Transformation is Driving Innovation in the FinTech Industry?

Digital transformation strategies played a major role in the expansion of the FinTech sector. From startups to well-established companies, they have utilized the benefits of digital transformation and witnessed massive business growth. Moreover, the advent of digital technologies has significantly changed the financial sector by making it more technologically relevant and user-oriented. The global digital market was USD 731 billion in 2022, growing at 23.1% of CAGR between 2023 and 2030.

Due to digital transformation initiatives, the financial sector can deliver an enhanced experience to its stakeholders and users. It has also increased customer satisfaction, business innovation, and employee satisfaction, making FinTech services work faster and more effectively in the competitive market. This article presents digital transformation trends and their benefits to the FinTech industry.

How does Digital Transformation Relate to Innovations?

Digital transformation and modernization in the FinTech sector are co-related, with one being the driving force for the other. The introduction of digital FinTech has revolutionized the financial sector dramatically, offering a space for the evolution and growth of various FinTech innovations. Digitalization not only enhances the user experience and streamlines processes but also helps eliminate traditional financial services and introduce new reforms for all agile and tech-driven FinTech organizations.

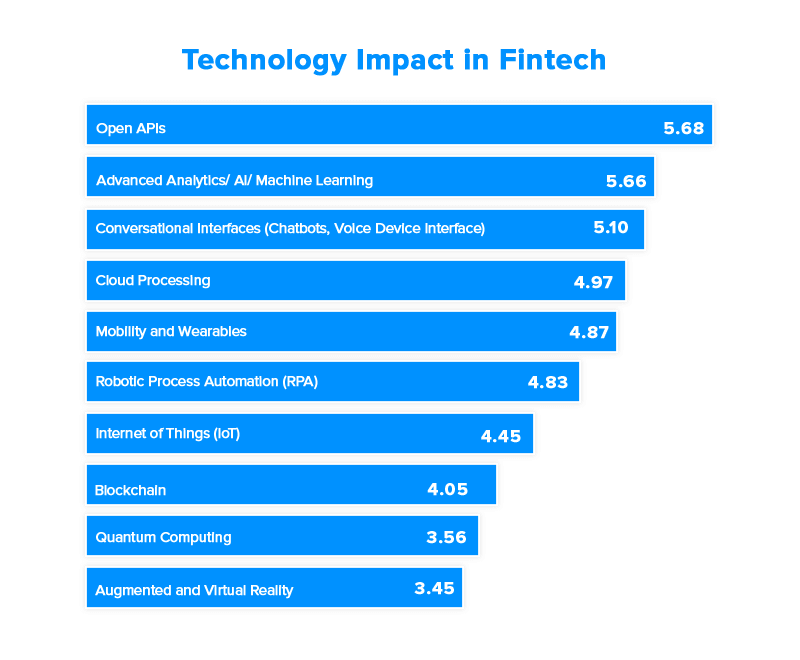

FinTech companies have fully benefited from this transformation and have developed various innovations, from mobile payment to peer-to-peer lending systems, blockchain technology, and robo-advisors. Data analytics and AI have also advanced thanks to digital transformation, completely changing this process. These technologies are used by FinTech businesses to detect fraud, better assess credit risk, and provide clients with individualized financial advice. These data-driven insights give FinTech pioneers a competitive edge and aid in the quick growth of their consumer base.

What is the Impact of Digital Transformation in the FinTech Industry?

- Reducing Complexities

- Nowadays, the financial sector has become too competitive. Therefore, it has become essential to simplify online processes and make them exceedingly secure and effective. The financial services industry’s transition to the digital age greatly impacts this. One of its main benefits is that it reduces the complexity of the financial industry, making the process more approachable.

- For instance, FinTech products and services with plenty of features may enhance user experience, automate processes, and perform various other tasks. As a result, the financial industry must undergo a digital revolution. Top-notch enterprise software development services providers can help you with digital transformation solutions for your FinTech company and other financial organizations.

- Increased Flexibility in Financing

- Due to their inability to measure all essential variables for lending, legacy systems continue to be unproductive in the present day. In short, SMEs need to earn revenue from all the traditional lending services. Moreover, they are quite expensive and less flexible than FinTech solutions. On the contrary, FinTech applications use the benefit of cloud technology. It can easily interact with the asset system, providing a supportable and user-friendly digital model that increases flexibility in the lending solution.

- Increasing Business Versatility

- The past decade has already witnessed some major financial crises. Businesses are expanding their agility to safeguard themselves, which has become a crucial market trend. The financial sector and businesses necessitate quick access to expanding information volumes without instigating tedious, time-consuming manual processes. Therefore, they can easily enhance their agility by utilizing digital transformation strategies through constant advancement and development.

- The Growth of FinTech into New Sectors

- Digital transformation in the FinTech sector has paved the way for new markets. FinTech services are connecting with more customers and businesses by providing various digital services, including advanced online lending platforms. More than 50% of banks have partnered with FinTech within the past 3 years due to competitive pressure. This rapid expansion plays a critical role in the growth of FinTech services as more and more people connect with it and enjoy the benefits of using FinTech solutions.

- Leveraging Big Data to Encourage Creativity

- The utilization of mass data has already become an effective trend in the finance sector recently. Digital transformation in banking industry helps banks to use innovative ideas for selling their products and utilizing data to offer personalized services to their users. Moreover, the FinTech companies use these customer data to enhance machine learning algorithms, which will reduce labor costs by enabling automation in the finance sector. By 2027, the global machine-learning market will be USD 117 billion.

- Adopting RPA for Seamless Operations

- Financial companies constantly try to reduce costs while increasing their productivity and investment return. Thus, RPA (Robotic Process Automation) comes to the rescue by boosting efficiency and productivity. By enabling digital transformation in financial services, RPA eliminates typical bank employees’ repetitive and monotonous work.

- Moreover, it reduces common mistakes and inadequacies. According to the latest study, over 80% of FinTech companies are adopting this automation process, thus digitalizing the finance sector for a seamless experience.

- Enhanced Risk Assessment

- Artificial intelligence, blockchain technologies, and data analytics are useful for more accurate and quicker diligence processes. Utilizing them in FinTech services can help you adopt digital transformation. It enhances risk assessment and provides security on various financial transactions, including loan disbursement.

Unlock Efficiency & Growth with Tntra’s Loan Management Platform. Read Our Case Study Now!

Final Verdict

Digitalization of the financial sector plays a significant role in its growth and expansion. The evolution of FinTech app development services substantially impacts financial service organizations. Every business must emply digitalization to survive the competitive market and provide the best-known service to its clients. Moreover, it also ensures top-notch security to its users, thereby increasing scalability and user experience.

If you want to thrive in the market by introducing digitalization to your organization or need assistance mid-way, BoTree Technologies, a renowned FinTech software development company, comes to your rescue. Our experienced professionals are specialized in cutting-edge FinTech solutions.

Call BoTree experts today for tailored FinTech solutions to meet your business needs.